The Forten Company Statement of Cash Flows is a critical financial document that provides valuable insights into a company’s financial performance. This statement Artikels the sources and uses of cash, offering a comprehensive overview of a company’s cash flow activities.

This guide will delve into the intricacies of the Forten Company Statement of Cash Flows, exploring its components, significance, and implications for businesses.

Statement of Cash Flows Overview: Forten Company Statement Of Cash Flows

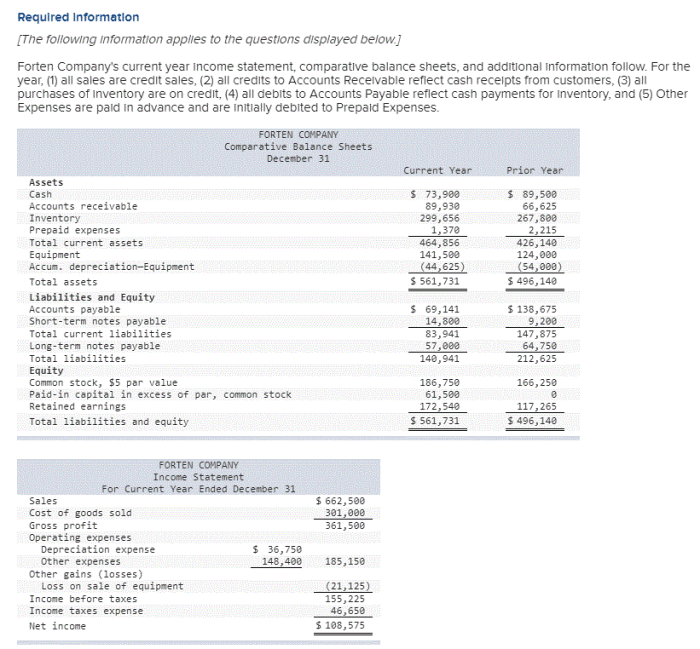

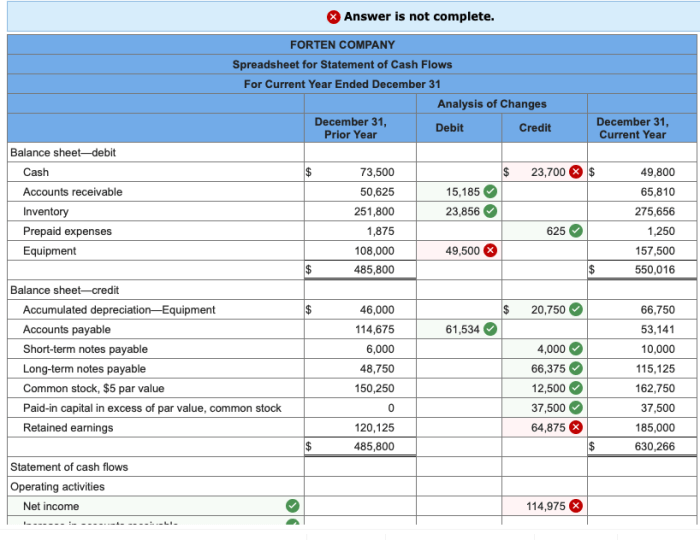

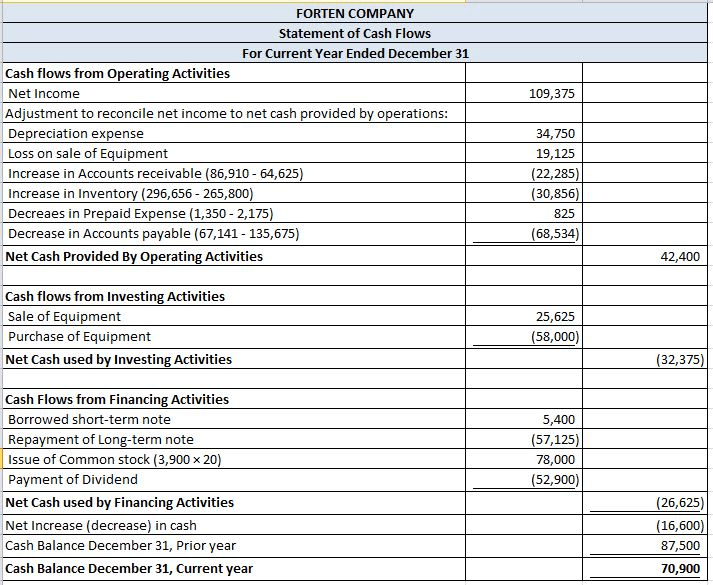

A statement of cash flows is a financial statement that summarizes the cash inflows and outflows of a company over a specific period of time, typically a quarter or a year. It provides insights into the sources and uses of cash, and is essential for evaluating a company’s liquidity, financial flexibility, and overall financial health.

The statement of cash flows is divided into three main sections: operating activities, investing activities, and financing activities.

Operating Activities

Operating activities refer to the day-to-day operations of a business, including revenue generation, expenses, and other cash flows related to the production and sale of goods or services.

Examples of transactions classified as operating activities include:

- Cash received from customers for products or services

- Cash paid to suppliers for inventory

- Cash paid for salaries and wages

- Cash paid for rent and utilities

| Cash Inflows | Cash Outflows |

|---|---|

| Sales revenue | Cost of goods sold |

| Service revenue | Salaries and wages |

| Interest received | Rent and utilities |

| Other operating income | Taxes |

Investing Activities, Forten company statement of cash flows

Investing activities involve the acquisition and disposal of long-term assets, such as property, plant, and equipment, as well as investments in other companies.

Common types of investing activities include:

- Purchase of property, plant, and equipment

- Sale of property, plant, and equipment

- Purchase of investments in other companies

- Sale of investments in other companies

| Cash Inflow | Cash Outflow |

|---|---|

| Sale of property, plant, and equipment | Purchase of property, plant, and equipment |

| Sale of investments | Purchase of investments |

Financing Activities

Financing activities relate to the raising and repayment of debt and equity capital.

Examples of transactions that fall under financing activities include:

- Issuance of stock

- Repurchase of stock

- Issuance of bonds

- Repayment of bonds

- Payment of dividends

| Cash Inflow | Cash Outflow |

|---|---|

| Issuance of stock | Repurchase of stock |

| Issuance of bonds | Repayment of bonds |

| Payment of dividends |

Cash Flow from Operations

Cash flow from operations is a measure of the cash generated by a company’s core business activities. It is calculated by adding net income to depreciation and amortization, and then subtracting changes in working capital.

Cash flow from operations is a key indicator of a company’s financial health and ability to generate cash internally.

Factors that can affect cash flow from operations include:

- Sales volume

- Cost of goods sold

- Operating expenses

- Changes in working capital

Free Cash Flow

Free cash flow is a measure of the cash available to a company after it has paid for its operating expenses and capital expenditures. It is calculated by subtracting capital expenditures from cash flow from operations.

Free cash flow is important for a number of reasons, including:

- It can be used to pay dividends or repurchase stock

- It can be used to fund acquisitions or other growth initiatives

- It can be used to reduce debt

Top FAQs

What is the purpose of a statement of cash flows?

A statement of cash flows provides information about the sources and uses of cash during a specific period, typically a quarter or a year.

What are the three main sections of a statement of cash flows?

Operating activities, investing activities, and financing activities.

What is cash flow from operations?

Cash flow from operations represents the cash generated or used in the core business operations of a company.

What is the importance of free cash flow?

Free cash flow measures the cash available to a company after accounting for capital expenditures and other non-cash expenses.